Attainable Housing Credit

The attainable “New Homes” Development Program, administered by Housing New Mexico/Mortgage Finance Authority, is a strategic investment in New Mexico’s future, directly addressing an estimated 32,000-unit statewide housing deficit. The program enables thousands more New Mexico families to become homeowners, creates generational wealth, supports jobs, and strengthens communities by lowering home purchase prices and monthly mortgages.

Economic data points to an additional 6,000-7,000 New Mexico families able to afford the mortgage on a median priced home for every $10,000 reduction in price.

Increase Production of Attainable Housing Units

- Bill creates the New Homes Development Program within the New Mexico Mortgage Finance Authority to deliver flexible-use home-buyer assistance grants of $10,000.

- Provides targeted and flexible financial support to homebuyers under the Affordable Housing Act, with funds available for down payment assistance, mortgage rate buydowns, loan repayments, or tax assessments.

- Allocates $30 million from the general fund for fiscal years 2027-2029 to fund grants that directly incentivize construction and create markets for the sale of attainable units.

- MFA administers the program, sets rules for oversight, home buyer eligibility, grant disbursement (up to $10,000 per grantee at home closing).

- Grants are disbursed only to qualifying grantees meeting program criteria pursuant to the Affordable Housing Act.

- Requires annual reporting starting July 1, 2027, to the oversight committee on grants awarded and program recommendations.

Economic Impact

By improving conditions for New Mexico families to realize the American dream of home ownership, this program builds generational wealth and creates positive economic impact in our communities. The program stimulates a crucial increase in for-sale housing production that will not otherwise exist – ramping up to 1,500+ additional units built by year #3. The (year #1*) economic impacts of building 100 homes in the State of New Mexico include:

- $36.1M in income for residents, supporting 447 jobs in New Mexico [1]

- $6.0M in taxes and other revenue for the state government and local [1]

governments in the state. ($2.3M annual recurring impact year after year)

- Ripple effects: boosts retail, healthcare, education, and services [1]

- Each $15 reduction in a monthly mortgage payment enables an additional 680 New Mexico households to qualify for a new a home [2]

* Additional, annually recurring impacts of building 100 single-family homes in New Mexico include $5.7 million in income for New Mexico residents, $2.3 million in taxes and other revenue for the state and local governments in the state, and 84 jobs in New Mexico.

[1] NAHB Report: The Economic Impact of Home Building in New Mexico – 09/2025

[2] NAHB Housing Priced-Out Report – 2025

Partnering for Housing Solutions

We Build New Mexico Together

- New Mexico's housing industry supports over 50,000 jobs and contributes billions to the state's economy annually. (Every 100 homes built in NM supports over 600 good-paying NM jobs results in $8.7M in tax revenue to local and state governments.)

- Solutions that eliminate costs home buyers pay for off-site infrastructure improvements can lower an average-priced home by 2.5% (approx. $10,000 on an average-priced NM Home.)

- Reducing NM's unique and significant tax burden on attainable housing units could reduce the average priced home by +/- 3.0%. (approx. $10,000 on an average-price NM Homes.)

The Challenge: Housing Attainability

New Mexico's families are struggling to find homes they can affor

- New Mexicans PRICED-OUT. Less than 14% of residents are able to afford the mortgage on a median-priced home.

- Regulatory costs and Gross Receipts Tax (GRT) account for up to 30% of the price of a new home, making housing less accessible. An average-price new NM home ($441K) includes over $35K in GRT taxes (state and local), ~200% of the tax burden of surrounding states.

- New Mexico is short more than 32,000 housing units w the largest gaps in workforce housing.

- Urban areas like Albuquerque, Las Cruces, and Santa Fe face high land and construction costs, driving up prices and limiting supply.

- Rural communities face a different challenge: limited housing stock, aging infrastructure, and fewer developers, making it hard for families to find quality homes.

- Median home prices in New Mexico rose 40% since 2019, while wages have not kept pace.

- Nearly 1 in 3 renter households in NM are cost-burdened, spending +30% of their income on rent.

Housing Affordability & Availability are national issues. New Mexico has unique advantages that position us well to address the challenge. NMHBA is ready to provide data, policy ideas, and community insights to help leaders craft meaningful, actionable housing solutions. We are your go-to resource on housing affordability.

Sources:

NAHB Housing Policy Dept Report: The Economic Impact of Home Building in New Mexico – 09/2025

NAHB Report: Comparing Costs to Revenue for Local Governments – 09/2025

SAMPLE SETTLEMENT Statement: how the Attainable Housing Credit flows to home buyer – 10/2025

.

Download one-pager on 2026 New Homes Development Program “Attainable Housing Bill”

Download 09-2025 NAHB Reports on Positive Economic Impacts of Housing New Mexico.

CLICK for Sample Settlement Statement:

this simple, verifiable legal document demonstrates how the Attainable Housing Credit benefits the home buyers.

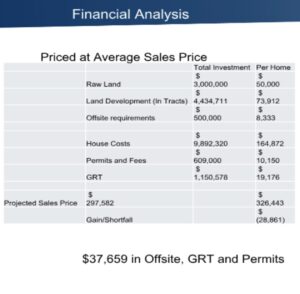

CLICK for Financial Analysis:

Presented before 7/21/25 Mortgage Finance Authority Act Oversight Committee, this presentation explains why housing developments are GO! or NoGo! in today’s “housing-economics” landscape.