Attainable Housing Credit

The Attainable Housing Credit Bill is a strategic investment in New Mexico’s future—supporting families, homeownership, creating jobs, and strengthening communities through increased production of new attainable housing. Builder and/or Fiscal Partner provided financial incentives ensure transparency, accountability and are designed to increase the pool of eligible New Mexico homebuyers, stimulating development for new affordable and attainable homes.

Purpose: Increase the production of Attainable Housing units by:

• Reducing Home Purchase Costs via a Closing Credit

• Improving affordability for homebuyers

• Stimulating private construction for 1,000+ of additional residential units per year that would not otherwise have been economically viable for the home building industry

How the Bill Works – Builder/Partner-Provided Incentives:

- Program Fiscal Agent provides a credit of up to $10K to individual home buyers of at closing

- Buyer is able to use the credit towards the down payment

- Builders can calculate the anticipated credits as they consider development opportunities, increasing the number of viable residential housing development projects

Eligibility & Oversight

• Eligible Homes are priced below Housing NM’s (MFA) FirstHome Program price caps with maximum mortgage limit for the county of purchase – currently $544,255 for 24 of 26 NM Counties.

• Applies to newly built for-sale homes: single-family, townhouses & condominiums.

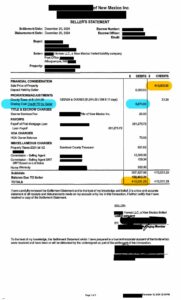

• Builders is required to document purchase price and buyer credit by submitting the settlement statement and copy of recorded deed.

• Program runs through 2029, with opportunities for increased legislative funding

Economic Impact

The objective for Legislation is to increase home production for sale by 25% across the State of NM (ramping up to 1,500+ additional homes built annually by year #3). The estimated one-year economic impacts of building 100 homes in the State of New Mexico include:

• $36.1M in income for residents, supporting 447 jobs in New Mexico (1)

• $6.0M in taxes and other revenue for the state and local governments. ($2.3M annual recurring impact year after year.) (1)

• Ripple effects: boosts retail, healthcare, education, and services (1)

• Each $15 reduction in a monthly mortgage payment enables an additional 680 New Mexico households to qualify for a new home (2)

[1] NAHB Report: The Economic Impact of Home Building in New Mexico – 09/2025

Partnering for Housing Solutions

We Build New Mexico Together

- New Mexico's housing industry supports over 50,000 jobs and contributes billions to the state's economy annually. (Every 100 homes built in NM supports over 600 good-paying NM jobs results in $8.7M in tax revenue to local and state governments.)

- Solutions that eliminate costs home buyers pay for off-site infrastructure improvements can lower an average priced home by 2.5% (approx. $10,000 on an average-price NM Home.)

- Reducing NM's unique and significant tax burden on attainable housing units could reduce the average priced home by +/- 3.0%. (approx. $10,000 on an average-price NM Homes.)

The Challenge: Housing Attainability

New Mexico's families are struggling to find homes they can afford

- New Mexicans PRICED-OUT. Less than 14% of residents are able to afford the mortgage on a median-priced home.

- Regulatory costs and Gross Receipts Tax (GRT) account for up to 30% of the price of a new home, making housing less accessible. An average-price new NM home ($441K) includes over $35K in GRT taxes (state and local), ~200% of the tax burden of surrounding states.

- New Mexico is short more than 32,000 housing units w the largest gaps in workforce housing.

- Urban areas like Albuquerque, Las Cruces, and Santa Fe face high land and construction costs, driving up prices and limiting supply.

- Rural communities face a different challenge: limited housing stock, aging infrastructure, and fewer developers, making it hard for families to find quality homes.

- Median home prices in New Mexico rose 40% since 2019, while wages have not kept pace.

- Nearly 1 in 3 renter households in NM are cost-burdened, spending +30% of their income on rent.

Housing Affordability & Availability are national issues. New Mexico has unique advantages that position us well to address the challenge. NMHBA is ready to provide data, policy ideas, and community insights to help leaders craft meaningful, actionable housing solutions. We are your go-to resource on housing affordability.

Sources:

NAHB Housing Policy Dept Report: The Economic Impact of Home Building in New Mexico – 09/2025

NAHB Report: Comparing Costs to Revenue for Local Governments – 09/2025

SAMPLE SETTLEMENT Statement: how the Attainable Housing Credit flows to home buyer – 10/2025

.

Download 09-2025 NAHB Reports on Positive Economic Impacts of Housing New Mexico.

CLICK for Sample Settlement Statement:

this simple, verifiable legal document demonstrates how the Attainable Housing Credit benefits the home buyers.

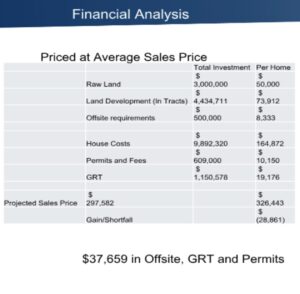

CLICK for Financial Analysis:

Presented before 7/21/25 Mortgage Finance Authority Act Oversight Committee, this presentation explains why housing developments are GO! or NoGo! in today’s “housing-economics” landscape.